Seward County Nebraska Real Estate Taxes . The amount of real estate taxes, including. Enter your search criteria in the fields on the right. The new taxes will be posted after. the assessor is responsible for discovering, listing, and valuing all taxable property in seward county. assessed values are subject to change by the assessor, county board of equalization or state equalization process. the tax rates are set by october 20th each year. search public real estate records for assessment, tax, sales, ownership and other property information. Clicking the search button next to the row you want to search. information on personal property. Contact the county treasurer if you have a question on the following: search for your property (real estate or personal). the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Select the statement you want to pay or view. The taxing entities that use your tax dollars establish what your taxes will be. Select the property's parcel id from a list.

from www.vrogue.co

search public real estate records for assessment, tax, sales, ownership and other property information. The taxing entities that use your tax dollars establish what your taxes will be. assessed values are subject to change by the assessor, county board of equalization or state equalization process. Select the statement you want to pay or view. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. information on personal property. search for your property (real estate or personal). Clicking the search button next to the row you want to search. The amount of real estate taxes, including. The new taxes will be posted after.

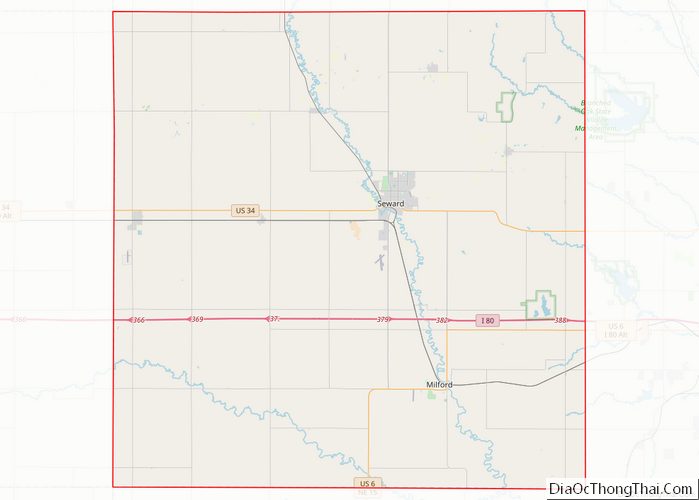

Seward County Ne Wall Map Premium Style By Marketmaps vrogue.co

Seward County Nebraska Real Estate Taxes Enter your search criteria in the fields on the right. Clicking the search button next to the row you want to search. The taxing entities that use your tax dollars establish what your taxes will be. The amount of real estate taxes, including. Contact the county treasurer if you have a question on the following: the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. the tax rates are set by october 20th each year. search public real estate records for assessment, tax, sales, ownership and other property information. Enter your search criteria in the fields on the right. assessed values are subject to change by the assessor, county board of equalization or state equalization process. The new taxes will be posted after. Select the property's parcel id from a list. Select the statement you want to pay or view. the assessor is responsible for discovering, listing, and valuing all taxable property in seward county. search for your property (real estate or personal). information on personal property.

From www.realtor.com

Seward, NE Real Estate Seward Homes for Sale Seward County Nebraska Real Estate Taxes Select the property's parcel id from a list. search for your property (real estate or personal). The taxing entities that use your tax dollars establish what your taxes will be. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Enter your search criteria in the fields on the. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

401 S 3rd St, Seward, NE 68434 Seward County Nebraska Real Estate Taxes information on personal property. Select the statement you want to pay or view. the tax rates are set by october 20th each year. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. The new taxes will be posted after. search for your property (real estate or. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

Seward County, NE Real Estate & Homes for Sale Seward County Nebraska Real Estate Taxes Select the property's parcel id from a list. the tax rates are set by october 20th each year. information on personal property. Select the statement you want to pay or view. search for your property (real estate or personal). Enter your search criteria in the fields on the right. Clicking the search button next to the row. Seward County Nebraska Real Estate Taxes.

From www.landwatch.com

Seward, Seward County, NE Farms and Ranches, Recreational Property, Horse Property for sale Seward County Nebraska Real Estate Taxes Select the statement you want to pay or view. search public real estate records for assessment, tax, sales, ownership and other property information. The new taxes will be posted after. Enter your search criteria in the fields on the right. Clicking the search button next to the row you want to search. information on personal property. The taxing. Seward County Nebraska Real Estate Taxes.

From topforeignstocks.com

Property Taxes by State Chart Seward County Nebraska Real Estate Taxes search for your property (real estate or personal). assessed values are subject to change by the assessor, county board of equalization or state equalization process. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. search public real estate records for assessment, tax, sales, ownership and other. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

Seward County, NE Real Estate & Homes for Sale Seward County Nebraska Real Estate Taxes the tax rates are set by october 20th each year. Clicking the search button next to the row you want to search. Select the statement you want to pay or view. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Contact the county treasurer if you have a. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

Seward, NE Real Estate Seward Homes for Sale Seward County Nebraska Real Estate Taxes The amount of real estate taxes, including. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Clicking the search button next to the row you want to search. The taxing entities that use your tax dollars establish what your taxes will be. information on personal property. Contact the. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

Seward, NE Real Estate Seward Homes for Sale Seward County Nebraska Real Estate Taxes The amount of real estate taxes, including. the assessor is responsible for discovering, listing, and valuing all taxable property in seward county. Contact the county treasurer if you have a question on the following: the tax rates are set by october 20th each year. the office of the seward county treasurer collects and disburses real and personal. Seward County Nebraska Real Estate Taxes.

From www.realtor.com

Seward County, NE Real Estate & Homes for Sale Seward County Nebraska Real Estate Taxes assessed values are subject to change by the assessor, county board of equalization or state equalization process. The taxing entities that use your tax dollars establish what your taxes will be. Contact the county treasurer if you have a question on the following: search public real estate records for assessment, tax, sales, ownership and other property information. . Seward County Nebraska Real Estate Taxes.

From www.landsofamerica.com

5.74 acres in Seward County, Nebraska Seward County Nebraska Real Estate Taxes The new taxes will be posted after. The taxing entities that use your tax dollars establish what your taxes will be. search public real estate records for assessment, tax, sales, ownership and other property information. Clicking the search button next to the row you want to search. The amount of real estate taxes, including. information on personal property.. Seward County Nebraska Real Estate Taxes.

From www.landwatch.com

Pleasant Dale, Seward County, NE Farms and Ranches, Recreational Property for sale Property ID Seward County Nebraska Real Estate Taxes the tax rates are set by october 20th each year. Select the statement you want to pay or view. assessed values are subject to change by the assessor, county board of equalization or state equalization process. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. The taxing. Seward County Nebraska Real Estate Taxes.

From www.landwatch.com

Pleasant Dale, Seward County, NE Farms and Ranches, Recreational Property for sale Property ID Seward County Nebraska Real Estate Taxes Contact the county treasurer if you have a question on the following: The taxing entities that use your tax dollars establish what your taxes will be. The amount of real estate taxes, including. Enter your search criteria in the fields on the right. the tax rates are set by october 20th each year. The new taxes will be posted. Seward County Nebraska Real Estate Taxes.

From mygenealogyhound.com

Seward County, Nebraska, map, 1912, Milford, Seward City, Germantown, Tamora, Beaver Crossing Seward County Nebraska Real Estate Taxes search public real estate records for assessment, tax, sales, ownership and other property information. Contact the county treasurer if you have a question on the following: search for your property (real estate or personal). The amount of real estate taxes, including. The new taxes will be posted after. Enter your search criteria in the fields on the right.. Seward County Nebraska Real Estate Taxes.

From uspopulation.org

Seward County, Nebraska Population Demographics, Employment, Housing Seward County Nebraska Real Estate Taxes search for your property (real estate or personal). the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. The amount of real estate taxes, including. Select the statement you want to pay or view. Clicking the search button next to the row you want to search. Select the property's. Seward County Nebraska Real Estate Taxes.

From tedsvintageart.com

Vintage Map of Seward County, Nebraska 1885 by Ted's Vintage Art Seward County Nebraska Real Estate Taxes The taxing entities that use your tax dollars establish what your taxes will be. information on personal property. Select the property's parcel id from a list. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Clicking the search button next to the row you want to search. The. Seward County Nebraska Real Estate Taxes.

From www.niche.com

2023 Best Places to Live in Seward County, NE Niche Seward County Nebraska Real Estate Taxes The taxing entities that use your tax dollars establish what your taxes will be. search for your property (real estate or personal). The amount of real estate taxes, including. the assessor is responsible for discovering, listing, and valuing all taxable property in seward county. Contact the county treasurer if you have a question on the following: Select the. Seward County Nebraska Real Estate Taxes.

From elitenebraska.com

Elite Nebraska Real Estate 2984 Fletcher Road , Seward, NE MLS 22018371 Seward County Nebraska Real Estate Taxes the assessor is responsible for discovering, listing, and valuing all taxable property in seward county. the office of the seward county treasurer collects and disburses real and personal property taxes and issues motor vehicle. Contact the county treasurer if you have a question on the following: Clicking the search button next to the row you want to search.. Seward County Nebraska Real Estate Taxes.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Seward County Nebraska Real Estate Taxes the tax rates are set by october 20th each year. The new taxes will be posted after. search for your property (real estate or personal). information on personal property. The amount of real estate taxes, including. The taxing entities that use your tax dollars establish what your taxes will be. Select the statement you want to pay. Seward County Nebraska Real Estate Taxes.